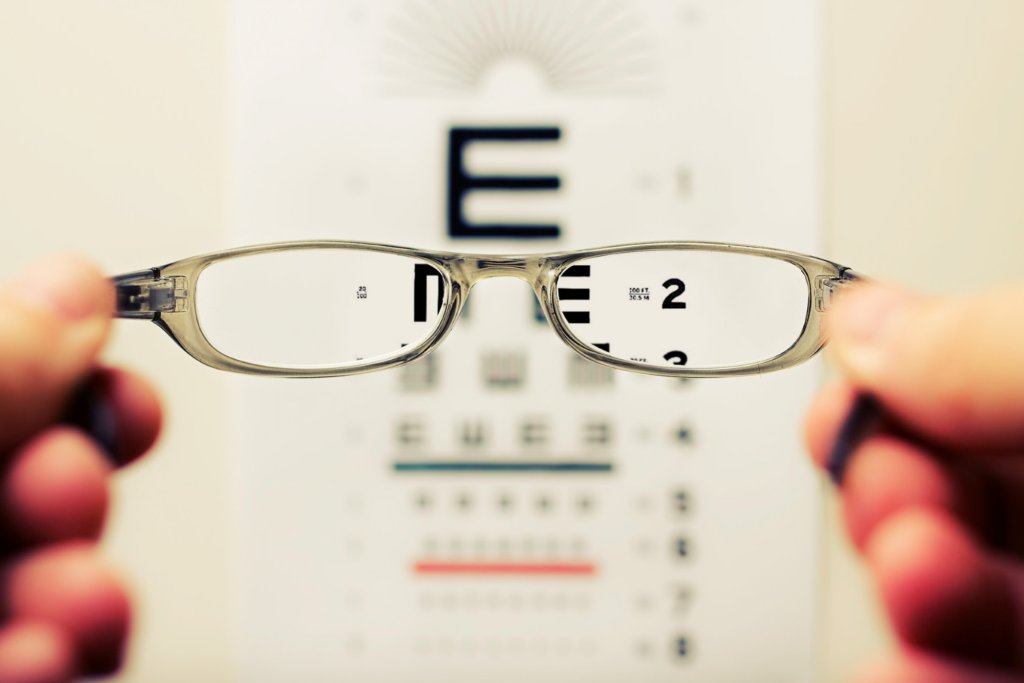

Hindsight is 20/20. Or is it?

When it comes to behavioural finance, I’d say it’s 20/40 at best.

As a former IFA, I know how much time investment professionals spend discussing boundaries with clients. We establish things like how much risk they’re comfortable with, or how they’d respond to their investment fluctuating in value, in order to create long-term plans.

We work hard to lay down mutually agreed ground rules. Then the client backtracks.

You probably know the feeling. A client contacts you because there’s been a fluctuation in their portfolio value (one which is well within what they agreed was acceptable) and now they’re panicking. They may even want to encash.

“I shouldn’t have agreed to this,” they say. “With hindsight, I made a mistake!”

But their real mistake is confusing hindsight with behavioural bias.

Too often, clients’ biases are triggered by predictable movements in the market. They respond emotionally, rather than with the cool logic which reflects their real long-term needs and objectives.

Wi-Ai helps your clients understand and take ownership of their biases, enabling them to avoid behaviour which is self-sabotaging and profit-damaging – for them and for you.

Want to learn more? Contact us [email protected]