Recency Bias and Investing

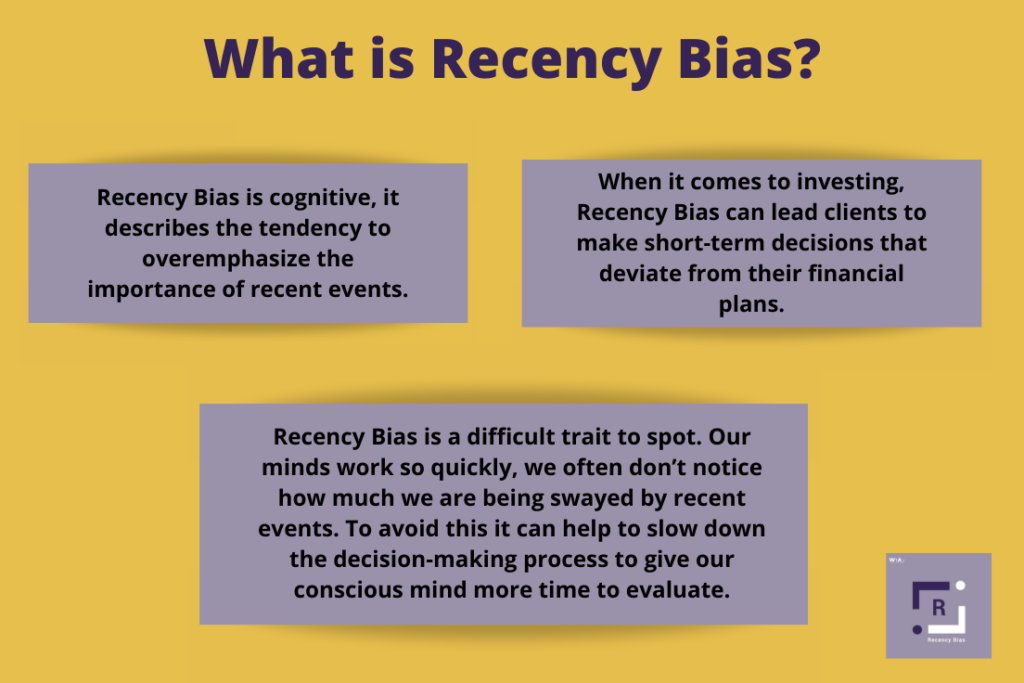

Recency Bias is a psychological phenomenon whereby we may give more importance to recent events compared to those that happened a while back. Some of us are more prone to Recency Bias than others.

So with this in mind, it’s unsurprising that Recency Bias can be a big factor when it comes to investing. For example, an investor may have lost some value in their funds over the past three months, but overall their investment may still have performed very well over the longer term. If the investor is prone to Recency Bias, they may attribute a disproportionate level of importance to (and thus focus on) the recent performance compared to other factors, such as the long term performance and future prospects of the investment. This may, in turn, lead to poor decision-making, such as encashing an investment based on what later turns out to be a temporary blip in value.

Recency Bias can be a costly issue for providers and customers alike.

By helping customers understand and take ownership of their biases, including Recency Bias, Wi-Ai behavioural bias software tools can help financial services providers to achieve more harmonious and potentially more profitable business relationships for both parties.

To discuss whether Wi-Ai Technology Limited can help you and your customers master biases, contact us at [email protected]